Biden’s debt forgiveness plan offers aid to educators

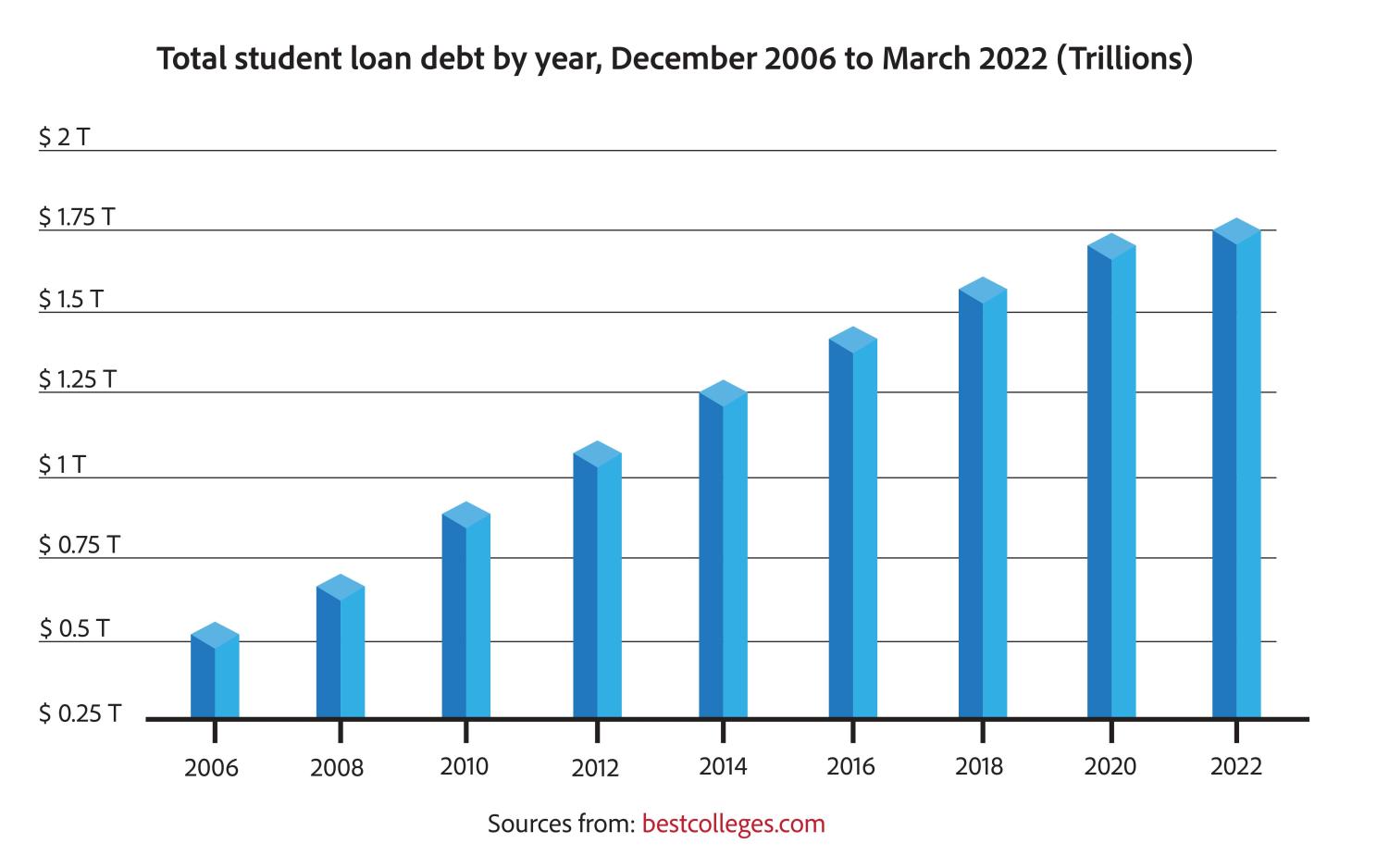

Biden’s debt forgiveness plan could offer $10,000 in federal loan forgiveness per person. On its current track, the plan could greatly benefit teachers and other educators who have an outstanding debt.

Fifty-eight percent of people ages from 18 to 29 years old report having student loan debt. https://educationdata.org/student-loan-debt-statistics

April 13, 2023

For many teachers at USD 266, the struggle to pay off loan debt is a constant battle. According to NEA.org, nearly half of all teachers take out a student loan to pay for their education, with the average amount taken out among them totaling $55,000 per teacher.

Emily Snyder, a social studies teacher at Maize South, spends nearly $600 on her student debt payments monthly, affecting her major financial decisions and personal life.

“It’s traditionally a pretty capped profession where you don’t get paid a lot because there’s not much room for raises, especially with excelling student loan debt,” said Snyder. ”I want to say the career field I went into has made it incredibly difficult to pay back that student loan debt.”

Many teachers have pursued further degrees to put off loan payments and earn money towards those loans. Teachers who seek further education, such as getting a master’s degree, can have their student loan payments deferred while they attend school.

“Specifically for me, there’s really no way to progress or excel in the career without getting additional degrees,” Snyder said. ”I went back to get my second master’s to put off paying off my student loan debt, I needed to take two years off, so I ended up getting an additional master’s so that I could have a break from paying student loan debt. It’s one of my most enormous bills every month.”

Biden’s debt relief plan would forgive almost $10,000 in federal student loan debt for teachers who still have yet to pay it off. The plan would cover $20,000 for those who have received Pell Grants in the past and $10,000 for those who haven’t.

“I hope it eliminates some of that debt. It would really be a positive impact on my overall finances for sure,” said Snyder.

Kacie Dix, a family and consumer science teacher at Maize South, says the program would help her afford supplies for her baby.

“My husband and I both have student loans, so we have not been able to afford certain things that we would like to do because we are making payments to repay our debts,” said Dix. ”It definitely would be nice to save that money each month. With a baby on the way, we will be spending a lot of money on baby supplies and daycare each month.”

The Supreme Court is currently reviewing the plan and is expected to reach a decision in June. Both members of Congress and the House have also made some pushback, with multiple bills being introduced by members to prohibit the debt forgiveness plan.

“I don’t see Congress or even really the House supporting anything that Biden pushes through,” said Snyder. ”So it may come in with whoever gets elected next, whether that’s Biden or another Republican. It would be up to that president to try to push it through, but I’m not optimistic if I’m being honest.”

Despite its potential benefits, many teachers feel that the plan would invalidate those who worked for both scholarships and other forms of funding for college and instead reward those who were later to pay off loans than others.

“I understand what the debt would do if we just started to eliminate that and make it easier to get college degrees,” said Snyder. ”I think that it’s nice for people, but it would also be incredibly frustrating to those who’ve worked hard and already paid off their student loan debt. So it’s like benefiting some of us that have really drug our feet along, paying off our student loan debt. Other teachers that I’ve talked to are incredibly frustrated because they worked so hard to pay that off early or to pay it off in a timely manner.”

Many others feel displeased with the state of the debt relief as well.

Chad Christensen, a social studies teacher at Maize South, feels that the national debt created from forgiving these loans would only harm the country and would only be taking tax dollars from others.

“Continuing to spend money this nation does not have and adding to the debt is never a good thing,” said Christenson. ”If the system is truly broken, why is no one talking about a fix? It will only pull money from my paycheck to pay off someone else’s debt.”

The plan as a whole would have many effects on the country, both positive and negative.

“There are definite pros and cons to the plan,” said Dix. ”One pro would be that a portion of our loans would be forgiven. A definite con would be that repaying those loans isn’t free- allowing it to pass is likely going to cause more inflation which would make a lot of things that we are already paying for more expensive. I think it’s really counterintuitive.“